Thomas Insurance Advisors Can Be Fun For Anyone

Facts About Thomas Insurance Advisors Uncovered

Table of ContentsThe Basic Principles Of Thomas Insurance Advisors Fascination About Thomas Insurance AdvisorsThe Ultimate Guide To Thomas Insurance AdvisorsMore About Thomas Insurance Advisors

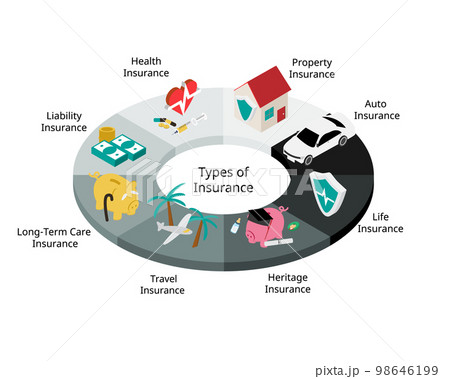

We can't stop the unanticipated from happening, but often we can protect ourselves and our family members from the worst of the economic after effects. 4 kinds of insurance coverage that most monetary specialists suggest include life, health and wellness, auto, and also long-term disability.Medical insurance protects you from devastating bills in situation of a severe accident or illness. Long-lasting handicap safeguards you from an unforeseen loss of income. Auto insurance policy avoids you from bearing the monetary concern of a costly accident. The 2 fundamental sorts of life insurance policy are conventional entire life and also term life.

It includes a fatality advantage and additionally a cash value part.

Things about Thomas Insurance Advisors

Bureau of Labor Stats, both partners functioned as well as brought in income in 48. Medicare/ Medicaid in Toccoa, GA. 9% of married-couple households in 2022. This is up from 46. 8% in 2021. They would certainly be most likely to experience economic difficulty as a result of among their wage earners' deaths. Medical insurance can be acquired with your company, the federal medical insurance market, or private insurance you get for on your own and also your family by getting in touch with medical insurance business directly or going with a health insurance representative.

If your earnings is low, you may be among the 80 million Americans that are eligible for Medicaid. If your income is moderate however doesn't extend to insurance policy coverage, you may be eligible for subsidized coverage under the government Affordable Care Act. The finest and also least pricey alternative for employed employees is typically joining your company's insurance program if your company has one.

Investopedia/ Jake Shi Lasting special needs insurance policy sustains those that become incapable to function. According to the Social Security Management, one in four employees going into the labor force will come to be impaired prior to they get to the age of retirement. While medical insurance spends for a hospital stay and medical costs, you are often burdened with all of the costs that your paycheck had covered.

The 10-Second Trick For Thomas Insurance Advisors

This would certainly be the ideal alternative for protecting affordable handicap coverage. If your company doesn't use long-term insurance coverage, here are some things to consider before acquiring insurance on your own: A policy that ensures revenue substitute is optimum. Several policies pay 40% to 70% of your income. The price of special needs insurance coverage is based on lots of variables, including age, lifestyle, as well as wellness.

Before you acquire, review the great print. Many plans need a three-month waiting duration before the protection starts, supply a maximum of 3 years' well worth of insurance coverage, and have considerable plan exclusions. Life Insurance in Toccoa, GA. In spite of years of renovations in vehicle safety, an approximated 31,785 people passed away in web traffic mishaps on united state

Virtually all states call for motorists to have automobile insurance coverage and the few that don't still hold vehicle drivers economically in charge of any damage or injuries they cause. Here are your choices when acquiring car insurance: Responsibility insurance coverage: Spends for building damage and injuries you cause to others if you're at mistake for an accident and likewise covers lawsuits costs as well as judgments or settlements if you're filed a claim against due to the fact that of an auto accident.

Comprehensive insurance covers burglary and damage to your cars and truck due to floodings, hail, fire, vandalism, falling items, and also animal strikes. When you finance your vehicle or lease an automobile, this kind of insurance is compulsory. Uninsured/underinsured motorist () protection: If a without insurance or underinsured driver strikes your vehicle, this coverage spends for you and your passenger's clinical expenses and may additionally represent lost income or make up for discomfort and suffering.

What Does Thomas Insurance Advisors Do?

Clinical payment insurance coverage: Medication, Pay insurance coverage assists pay for medical expenditures, normally between $1,000 and also $5,000 for you as find more information well as your guests if you're injured in an accident. Similar to all insurance coverage, your situations will figure out the expense. Contrast several price quotes as well as the protection provided, and also inspect occasionally to see if you get a reduced price based on your age, driving record, or the location where you live.

Company protection is often the very best option, yet if that is not available, get quotes from numerous companies as numerous supply price cuts if you buy more than one kind of insurance coverage.

There are several insurance plan, and also recognizing which is right for you can be challenging. This guide will certainly talk about the different types of insurance and what they cover. We will additionally offer pointers on picking the right policy for your requirements. Table Of Contents Medical insurance is just one of the most important kinds of insurance coverage that you can have.

Depending on the plan, it can likewise cover oral as well as vision care. It supplies monetary protection for your enjoyed ones if you can not support them.